Shortage of eggs set to continue in the UK

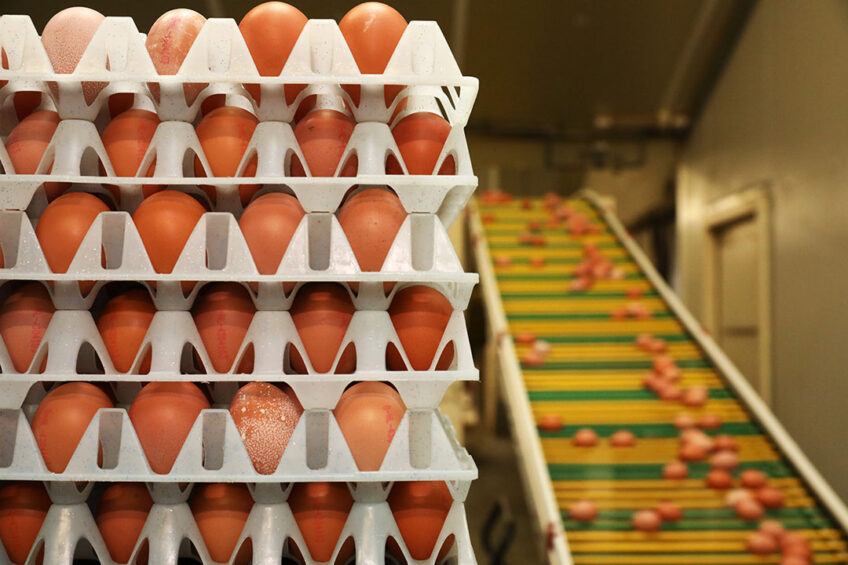

Egg shortages are set to leave retailers with a supply issue over the next few months amid a general scaling back in the UK industry and fears that supermarkets may turn to imports.

Producers and processors have been warning supermarkets of the impending shortages for more than a year, pointing out that the length of cycle means production increases cannot be switched on quickly. Houses taken out of commission require the whole cycle from parent breeders, egg set to hatching, pullet rearing, and transfer to laying farm before the egg supply kicks in.

“…at some point there will be a crisis in the retail sector, with consumers putting pressure on retailers to maintain more reliable stocks of eggs.”

Matthew Green, Wot A Pullet MD, said the company was seeing growth in orders for pullets, but this will not translate into eggs on supermarket shelves until autumn.

Green said he was concerned retailers hadn’t listened to the message, adding that it was going to take some time to recover: “In the meantime, it seems highly likely that at some point there will be a crisis in the retail sector, with consumers putting pressure on retailers to maintain more reliable stocks of eggs.

The likelihood of imports

“If retailers are forced to import eggs, and it becomes the new norm, it will have dire consequences for the sector. The value of the Lion Code and consumer loyalty to home-produced eggs could be permanently undermined. The longer the shortage persists, the greater the likelihood of imports. It is therefore incumbent on all parties to have an open discussion on the impact of egg imports growing.”

Green added that with major changes in the way the sector operates, swings of over-supply and paucity will continue: “One of the perennial problems the sector faces is that swings in the size of the UK laying flock cause fluctuations in returns. This makes medium-term planning and long-term investment projections incredibly difficult.

“…poultry farmers have seen their risks multiplied and their rewards divided.”

“As we have seen by the withdrawals from the market, due to unprecedented cost pressures, the ability of a producer to weather this crisis is dependent on where they happen to be in the investment cycle, the scale and timing of borrowing and when their energy and feed contract renewals fall. This is a level of uncertainty that would not be acceptable in many sectors.

“Over the last few years, with the now seemingly permanent issue of avian influenza, poultry farmers have seen their risks multiplied and their rewards divided,” he added.

Planning applications fall

It is becoming evident that the myriad of issues facing the sector are leading to a drastic decline in the number of planning applications. Ian Ian Pick, the owner of the specialist agricultural and rural planning consultancy Ian Pick Associates, said he had seen the lowest number of applications for free-range egg housing than in 17 years of being in the business.

“From what we might call its peak in 2010 when we were getting up to 50 applications at any one time, by contrast, we currently only have 2 live applications going through and 1 enquiry.”

Pick said the reason for the decline was down to poor margins: “Simply put, as we all know, supermarkets are paying less than the cost of production. We have seen many farmers get their fingers burned.”

But the doubling of the cost of building was also putting off potential producers, he added: “Brexit, the war in Ukraine and inflation have led to phenomenal increases. Hefty increases in the cost of steel, wood, equipment and concrete have huge impacts on build costs. A year ago, the cost to build a 32,000-bird poultry shed would be around £1.2 million. Today that cost is more like £1.8 million. The other factor is the cost of borrowing. Rates have gone from around 2% to 5% and the margins are not there.”

Commenting on the state of the broiler sector, Pick said there had been a few applications, but many farmers were restructuring, repurposing buildings for grain storage or housing.”