Alternative proteins beyond the hype

The dreamt breakthrough of alternative proteins looks to have stalled. After riding the hype for a couple of years, there is trouble in paradise. Large brands like Nestlé have pulled back from the market, Meatless Farm went bust and Beyond Meat saw share prices drop from an all-time high of US$234 to under US$15.

An editorial in the New York Times on 21 November 2022 stated: “For a while, it looked like Beyond Meat was taking over the world.” This was referring to the market for meat substitutes. However, in 2022, the company and several start-ups which produced and marketed plant-based meats, experienced an unforeseen drop in sales and investments in the technology of producing alternative proteins. Clearly, the companies had not succeeded in convincing new groups of buyers of the benefits of eating these products, as predicted.

Sales growth for most companies was much slower than expected; some even withdrew from production, while others reduced their product portfolio or laid off employees. Investments in start-ups and companies active in the alternative protein sector decreased significantly compared to 2021. However, this is not true for all continents, as the momentum of previous years continued in some regions. This article will look at the situation after the end of the coronavirus pandemic, which had a major impact on the sales of alternative foods.

Sharp decline in investment

Between 2010 and 2020, approximately US$6 billion was invested globally in the development of alternative proteins, including US$3 billion in 2020 alone. The following year saw an explosion in available funding to nearly US$5.1 billion. The coronavirus pandemic had resulted in a significant increase in retail sales of alternative foods and a growth spiral seemed to have been set in motion, promising high profits (Table 1).

Disillusionment set in by 2022, however, at least in North America, Latin America and West Asia. Sales volumes either fell significantly or were far below expectations. In addition, there were critical comments about some companies’ products in terms of quality and taste, as well as their marketing strategies. Some market leaders in quick-serve restaurants reduced the range of offers or discontinued the distribution of such products.

Surveys showed that the proportion of consumers who either wanted to try such products or to eat them permanently was more or less constant or increased only slightly. There was also criticism of the high price of plant-based meat compared to low-priced offers of conventional meat in retail stores.

Regional shifts

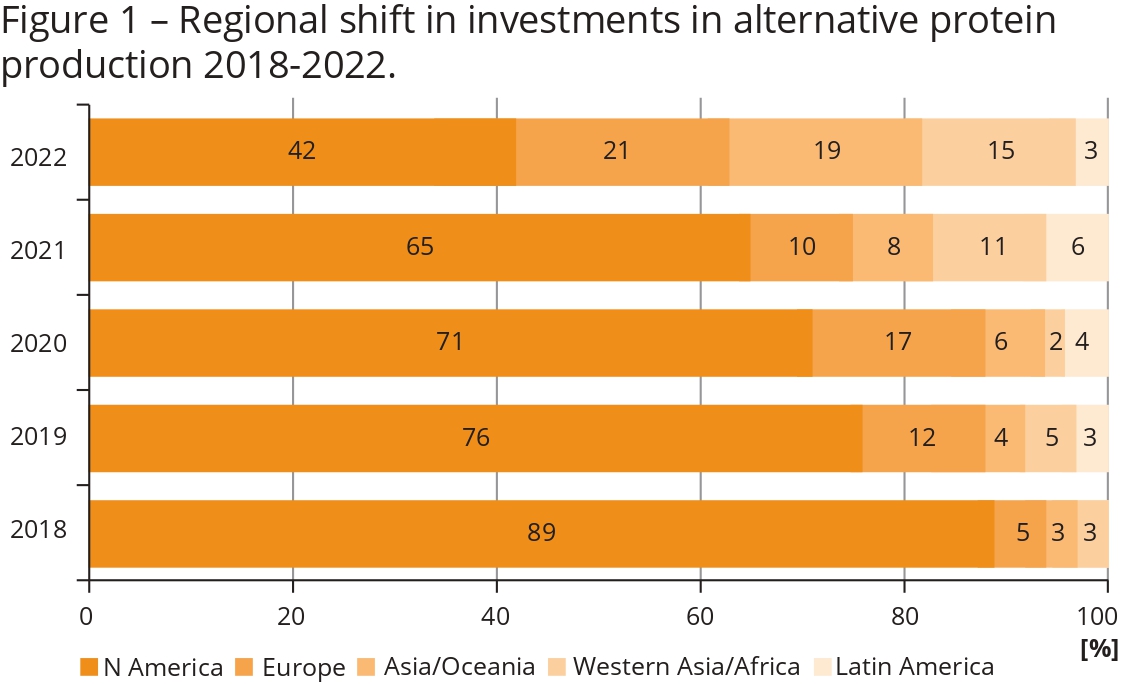

Investment did not decline evenly across the globe between 2021 and 2022. While Latin America (-76%), North America (-63%) and West Asia/Africa (-21%), in particular, saw major declines, it continued to increase in East and South Asia/Oceania (+43%) and Europe (+24%). This changed the regional investment pattern considerably (Figure 1).

Investment did not decline evenly across the globe between 2021 and 2022. While Latin America (-76%), North America (-63%) and West Asia/Africa (-21%), in particular, saw major declines, it continued to increase in East and South Asia/Oceania (+43%) and Europe (+24%). This changed the regional investment pattern considerably (Figure 1).While in 2018, North America was still in an unchallenged first place with a share of 89% of global investment, in 2022 its share had fallen to 42%, i.e., it had lost more than half. The clear winners were Europe and Asia. It is worth noting that the share of West Asia/Africa is almost exclusively due to investments made in Israel.

After a rapid increase from US$14 million in 2018 to US$620 million in 2021, however, there was also a 26.8% drop to just US$454 million. This slump is mainly due to the remaining technical problems in the production of meat from cell cultures, especially in the necessary scaling up of bioreactors which are essential for a continuous supply to the market. In addition to Israel, substantial funding was provided in Asia: in Singapore (US$214 million), China (US$176 million), South Korea (US$80 million) and Japan (US$76 million). In Australia, too, US$169 million was invested in the technological development of alternative proteins.

Stagnation

During the coronavirus pandemic, consumer behaviour changed decisively. While sales dropped sharply due to prolonged travel restrictions and restaurant closures, sales in the food retail sector increased. Meals were increasingly prepared again in the home, for which the necessary ingredients had to be provided.

With the end of the pandemic, the situation changed again. Sales in the food retail trade declined, while out-of-home consumption increased again, but did not reach the same volume as before the pandemic. Developments in system gastronomy changed considerably. While some chains expanded their range of meat alternatives, others ended their test phases in selected cities or countries due to unsatisfactory sales. Table 2 impressively documents this change in consumer behaviour for the US.

It is worth noting that, in contrast to other products, sales of egg replacers still increased between 2021 and 2022, but also suffered major losses compared to previous years. The number of units sold in grocery stores decreased particularly significantly between 2021 and 2022 for meat (especially beef patties), ready meals and plant-based bars which consumers had turned to significantly during the pandemic. A detailed analysis of the GFI at product level and form of supply showed that in 2022, frozen goods were preferred over chilled fresh products because of their lower price.

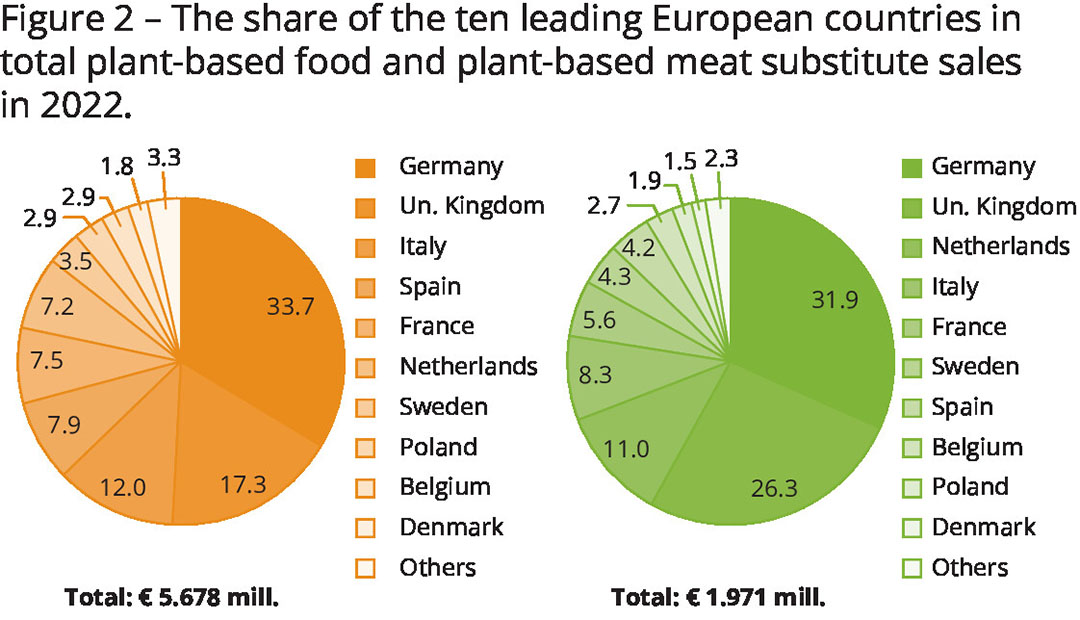

In Europe, the drop in sales was not as severe as in the US, but there, too, sales volumes and the number of units sold fell significantly. As can be seen in Table 3, sales volumes and the number of units sold of ready meals – which had experienced a real boom during the pandemic – fell most sharply in Europe as a whole, and in Germany. Buyers’ appreciation of meat also dropped significantly. Figure 2 shows the share of the 10 leading European countries in total plant-based food and plant-based meat sales in 2022.

Analyses of the causes for the declining buyer interest in alternative proteins tended to show that, above all, the taste of the products, the large number of ingredients used and the high technical effort in production were the reasons for declining or stagnating sales. While health aspects had moved to the forefront in the advertising of the products for a few years, a return to the known aspects (animal welfare, lower resource consumption and climate change) in addition to the health benefits, can be observed.

Approval is not everything

After Good Food, a subsidiary of Just Egg, received market approval for cell-cultured chicken meat in Singapore in December 2020, almost 2 years passed before further progress was reported in the application of this technology. An important step may have been the classification of the technology used by Upside Foods as a safe form of producing chicken meat by the US Food and Drug Administration (FDA) on 16 November 2022. However, this decision is not yet market approval. Further testing procedures are still necessary in the production facilities that are currently being set up. It will be several years before the product is available on the market in larger quantities.

Good Food was able to achieve another success after gaining market approval in Singapore. The company received market approval for cell-cultured chicken meat in March 2023. It may be assumed that the positive decisions of the FDA will open up new funding avenues for Upside Foods and Good Food.

Good Food was able to achieve another success after gaining market approval in Singapore. The company received market approval for cell-cultured chicken meat in March 2023. It may be assumed that the positive decisions of the FDA will open up new funding avenues for Upside Foods and Good Food.

However, market approval is not everything, as has been shown in Singapore. To be successful in the market, the potential buyer not only has to be convinced of the quality of the product offered but it must also be available at a price that does not deviate too much from that of conventionally-produced meat sold in retail stores. This requirement continues to cause problems, however, because the production of large bioreactors which are indispensable for the continuous production of quantities of interest to the market, not only requires major financial resources but also the development of an efficient and safe control technology.

Obviously, there is still a lot of development work necessary in this field. Interviews with potential consumers showed that some were sceptical or even rejected the complex technology that is necessary to obtain meat from cell cultures because they considered it unnatural. This will have prevented some investors in 2022 from continuing to provide funding at the same level as before, in addition to the unspecified period of time needed for market penetration.

The importance of alternative proteins to feed a growing world population has finally also been recognised in politics. The governments of several countries (e.g., Australia, China, India, Israel, Singapore, the US, UK and Germany) and the EU have provided funding for research into the technology used in the development of alternative proteins. However, the funding amounts are small compared to the funds provided by private investors or funding institutions.

Perspectives

Several years of rapidly increasing sales of plant-based foods have led to substantial investments in this technology. The increase in food retail sales was a result of restaurant closures and travel restrictions during the coronavirus pandemic. After the pandemic ended, food retail sales fell sharply, causing financial problems for a number of companies and start-ups. The failure to meet consumers’ expectations prompted several investors to stop providing funding. North America, Latin America and West Asia were particularly affected. In contrast, investments continued to be made in Europe and East Asia, albeit to a lesser extent than between 2019 and 2021.

Regarding the production of alternative foods from cell cultures, the decrease in investment was due to the looming period of years until market-relevant quantities would be available, on the one hand, and a clear scepticism among potential consumers towards products with a high technological input, on the other. It may be assumed, however, that recent decisions regarding the technologies used and the market approval of alternative products will likely result in a new wave of investments.

References available on request.