MARKETS: Feed cost falls back

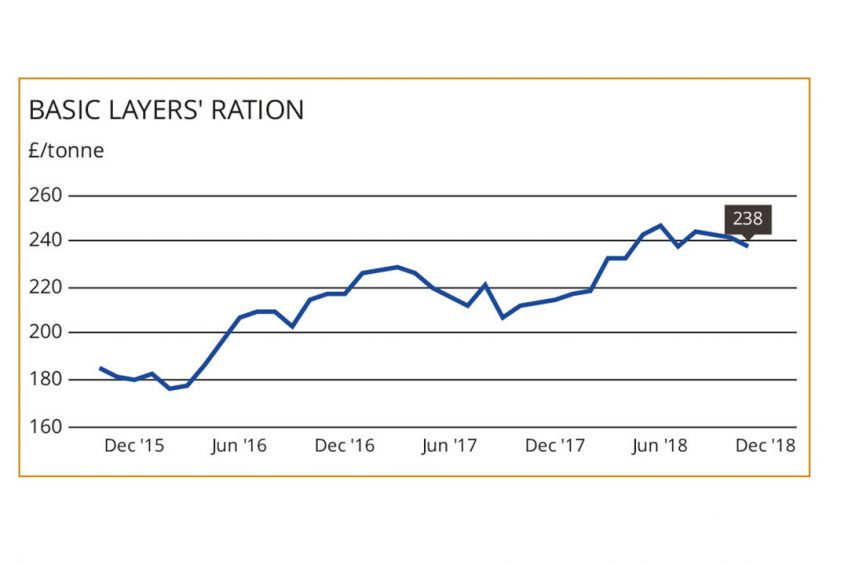

Some of the pressure on producers has eased a little as raw material prices have come off their summer highs, but feed costs still remain at relatively high levels.

Feed wheat spot prices have fallen an average £4 a tonne during the past month, and with soyameal showing little change over the same period, PW’s basic layers rations (see top right) has edged back another £3/t. It is now down £6/t since August overall. Feed wheat costs are still only back to where they were in August, and it is the sharper fall in the soya price that has had the biggest impact on rations costs in recent months. Soya has come down more than £70/t since it peaked in May, while feed wheat is still £20/t up over the same period. In fact, soya prices have been down further in recent weeks, and then recovered again with hopes of a solution to the trade dispute with China – and hence a recovery in US soya exports there – gaining a strong boost from the latest statement from President Trump.

As a result, “Chicago Soyabean gained back almost 2 weeks of losses in a single day of trade,” said Humphrey Feeds. It adds that China imported just 132,000T of soya beans from the US in September, down from 937,000T last year, while Brazil’s export figures were up 115% over last year. Further ahead, planting of soyabean crops for the 2018/19 crop season is underway in Brazil, indications are that the area could expand again from 2017/18’s record, noted AHDB.

Grain Market Drivers | ||

| WHEAT – Current sentiment is generally bearish, but some support came from the threat to winter wheat from heavy rain in the US. | ||

| | WHEAT – The USDA forecasts that total US wheat plantings will hit 20.6 mha for 2019/20, a rise of 6.7% on 2018/19. | |

| WHEAT – The FAO has raised its global wheat production forecast for 2018/19 by 9.2mt. | ||

| WHEAT – USDA figures predict a near-record hard red spring wheat crop for the US at 16.0mt, a rise of 53% on last year’s drought-stricken harvest. | ||

| SOYA – With exports languishing, the USDA estimates that US soyabean ending stocks for 2018/19 will reach 24.1Mt, the largest carry out on record. | ||

Growers’ Ration Price Index (Based on 100 in June 1976) | |||

| November | Month ago | Year ago | |

| Growers 15% protein | 277 | 271 | 233 |

| Source: HGCA and KW Feeds. NB. Soya meal now quoted for GM “any origin” material | |||

Raw Materials Prices (£/T) | |||

| 1-Nov | Month ago | Year ago | |

| Feed wheat, ex-farm | 166,30 | 170,50 | 138,60 |

| Feed barley, ex-farm | 164,30 | 163,60 | 123,90 |

| Soyameal, Hi-pro | 319,00 | 318,00 | 298,00 |

| Rapeseed meal, home prod | 178,00 | 232,00 | 174,00 |

| Wheatfeed pellets | 178,00 | 207,00 | 155,00 |

| Source: HGCA and KW Feeds. NB. Soya meal now quoted for GM “any origin” material | |||