Mexico chicken imports forecast to increase by 5% in 2024

Driven by robust domestic demand and the price competitiveness of chicken meat, Mexican chicken imports are forecast to increase by 5% in 2024 according to a recent US Department of Agriculture Global Agricultural Information Network report.

Domestic Mexican production is forecast 2% higher from 2023 to 3.9 million metric tonnes (mmt) in 2024 against a projected modest decline in feed prices and strong domestic demand. Increased household incomes will support a 3% increase in chicken meat consumption in 2024 at 4.9 mmt. On the other hand, greater biosecurity measures implemented to prevent disease in the aftermath of the outbreak of highly pathogenic avian influenza in 2022 and increased investments in broiler genetics are expected to support increased production.

Reports show that nearly half of Mexico’s feed production is destined for the poultry industry. The ability to access grain and develop poultry feed provides the domestic industry with a competitive advantage in poultry production. However, poultry producers are concerned about the availability of an adequate supply of animal feed in the future due to Mexico’s policy to manage the corn trade. The Mexican government recently published a presidential decree which includes a regulation intended to substitute the use of genetically-modified corn for animal feed and human food. This concern also emanates from the fact that most of the feed used to support Mexico’s poultry industry comes from grain imports.

Imports up by 5% in 2024

Imports are forecast at 5% higher from 2023 at 1.0 MMT in 2024. Strong domestic demand, increased household incomes and the price competitiveness of chicken meat compared to pork and beef, will support increased import volumes. Looking at the current year, based on updated trade data, 2023 imports are estimated 7% higher than in 2022 at 975,000 MT. A record-level appreciation of Mexico’s peso relative to the US dollar, strengthens the poultry import outlook. The United States remains Mexico’s top poultry trading partner, despite an estimated increase in imports from Brazil.

Less than 1% for export

Exports are forecast as unchanged from 2023 at 5,000 mt in 2024. Robust demand from domestic consumers and unchanged forecast demand from export markets are expected to stabilise exports. Although the industry aims to increase chicken meat exports, including capturing the halal meat markets, over the last 10 years, less than 1% of chicken meat production has been destined for export.

Similar to the 2024 forecast, exports are projected at 5,000 mt in 2023, which is 60% lower than in 2022. Mexico trade data shows limited shipments in the first half of the year and US demand is expected to remain weak for the remainder of 2023. Exports to the US were stronger in 2022 as demand rose due to the impact of highly pathogenic avian influenza.

Consumption to rise in 2024

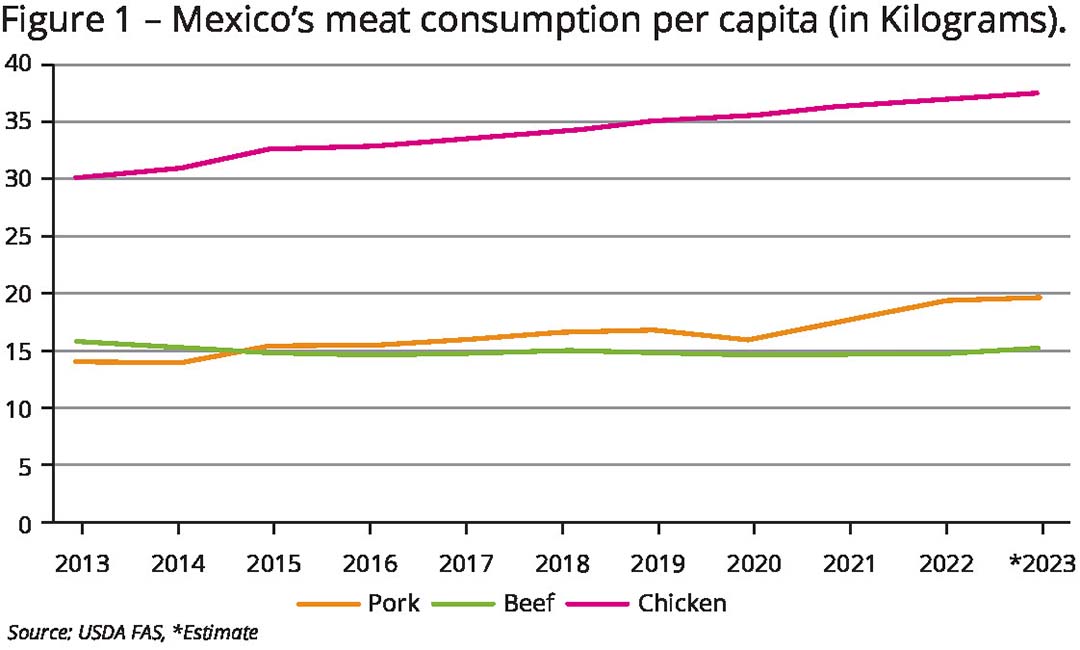

Reports show Mexico is the 5th-largest chicken meat consumer globally, while demand for chicken meat continues to rise. Chicken meat is Mexico’s most consumed animal protein and consumption is forecast at 3% higher in 2024 than in 2023, at 4.9 mmt. While consumption is also estimated to be 2% higher in 2023 than in 2022 at 4.8 mmt (see Figure 1). The rate of consumption growth per capita is forecast to be stronger in 2024 compared to 2023, driven by increased demand for processed products, such as cold cuts, and frozen breaded chicken meat.

Reports show Mexico is the 5th-largest chicken meat consumer globally, while demand for chicken meat continues to rise. Chicken meat is Mexico’s most consumed animal protein and consumption is forecast at 3% higher in 2024 than in 2023, at 4.9 mmt. While consumption is also estimated to be 2% higher in 2023 than in 2022 at 4.8 mmt (see Figure 1). The rate of consumption growth per capita is forecast to be stronger in 2024 compared to 2023, driven by increased demand for processed products, such as cold cuts, and frozen breaded chicken meat.

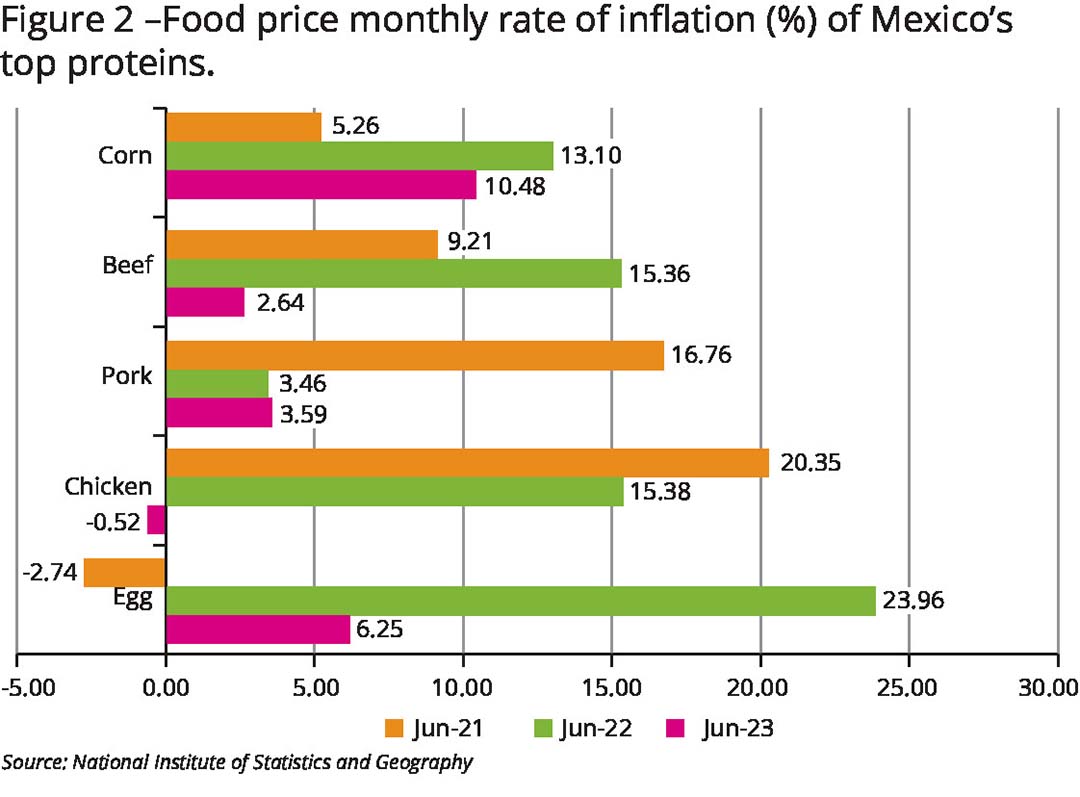

Overall, population growth combined with less strong inflation (see Figure 2), increased household incomes and remittances in 2023 and 2024 are forecast to support greater chicken meat consumption. Minimum wage increased by double digits between 2018-2023, rising to US$10.40 per day from US$4.40 per day. Remittances have also climbed to the highest levels in 10 years.

Policy shaping the country’s poultry sector

The Bank of Mexico and the International Monetary Fund have forecast Mexico’s gross domestic product growth in 2024 at 1.6%, meaning relatively less growth compared to the previous 2 years.

Political intervention may drive a crucial development for the poultry industry. Mexico’s Secretary of Agriculture announced that 48 agriculture-related regulations would be updated by the end of the year. Mexico’s voters will select a replacement for its current President Andrés Manuel López Obrador in 2024. During the run-up to the election, food prices, including that of chicken meat, will be top of mind for many voters. Concerns about potential economic volatility during the campaign and election period may hamper investments in the poultry sector.

Political intervention may drive a crucial development for the poultry industry. Mexico’s Secretary of Agriculture announced that 48 agriculture-related regulations would be updated by the end of the year. Mexico’s voters will select a replacement for its current President Andrés Manuel López Obrador in 2024. During the run-up to the election, food prices, including that of chicken meat, will be top of mind for many voters. Concerns about potential economic volatility during the campaign and election period may hamper investments in the poultry sector.

The Foreign Trade Practices Unit of Mexico’s Economy Secretariat held a hearing on 23 May 2023 about alleged US dumping of chicken products, a case which has been ongoing for more than 10 years. The results of the hearing are still pending. Looking back, the Economy Secretariat concluded in 2012 that US exporters were guilty of engaging in ‘unfair’ trade practices with their sales of chicken leg quarters to Mexico.

Mexico published a presidential decree on 13 February which includes a regulation stating that: “The dependencies and entities of the Federal Public Administration will carry out the actions leading to the effect of carrying out the gradual substitution of genetically-modified corn for animal feed and industrial use for human food.”

Poultry producers are concerned about this and whether it will affect the availability of an adequate supply of animal feed in the future. Imports could be on the rise as the government of Mexico has recently published a series of inflation-related decrees which temporarily allow the duty-free import of certain food products, including chicken meat, among other things. The recent outbreak of highly pathogenic H5N1 avian flu, however, could lead to additional imports to meet the domestic demand for chicken products.