Markets: Mixed picture – rations unchanged

This month the focus has shifted to feed wheat in driving prices upwards, while soya has eased back a little.

UK feed wheat gained around £5.50 a tonne since the last issue, to £146.2/t at the end of March. This marks the highest point since August last year.

Meanwhile, Soya fell back by £12/t to £158/t.

UK market drivers

Overall, the majority of UK market drivers in early April were of global origin, commented AHDB. Drought in Argentina has not improved the soya crop, but traders have started looking further ahead to the US soya crop, which is expected to hit a record level.

The bearish effect of this on soya prices has been reinforced by high soyabean stocks in the US, which at the start of March were 20% higher than a year earlier. Running alongside is the uncertainty over any reaction from China (as a major importer of soya) to the protectionist measures being adopted by the US on Chinese steel and aluminium exports. However, soya escaped an initial round of import tariffs imposed by China which included US pork products, for example.

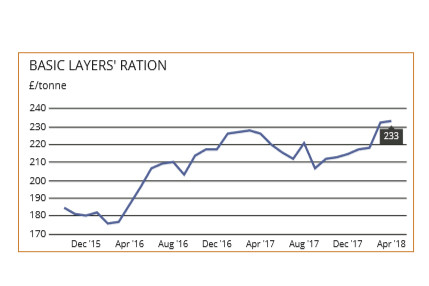

In any case, UK soya prices are still £40/t higher than at the start of this year, so the pressure on feed costs remains for now. Hence our estimated cost of a basic layer ration, after factoring in the rise in wheat costs and fall in soya, edged forward £1 this month to £233/t (see chart).

GRAIN MARKET DRIVERS | ||

| WHEAT – Damage to the US winter wheat crop remains an issue, with only 32% of the winter wheat crop in the US now being rated good to excellent in the April crop condition report. This is around 20 percentage points worse than a year earlier. | ||

| SOYA – Dry weather damage to the Argentine soya crop continues to result in lower crop forecasts. Having fallen in successive steps in February from 50m to 44m tonnes, the latest forecast from Buenos Aires is now down to 40mt. | ||

| | WHEAT – Although US wheat planting intentions show the second lowest area since records began in 1919, estimates has been raised 2% since an earlier survey by Reuter’s. Plantings should be up 3% compared with last year, mainly due to a 15% rise in spring wheat intentions. | |

| SOYA – US soyabean stocks, at 1 March, were estimated to be 21% higher than a year ago. During the previous three months, the drawdown in soyabean stocks was nearly 10% lower than the same period a year earlier. | ||