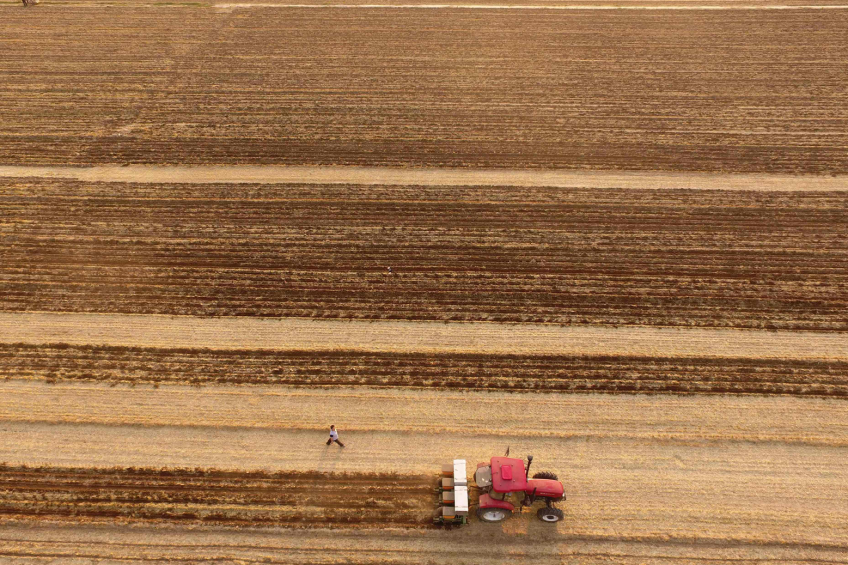

Limited corn supply challenges Brazilian poultry sector

Brazil’s limited corn supply is driving domestic prices up and having a significant impact on the poultry and pork sectors in the country.

A significantly lower than anticipated supply of corn continues to drive an increase in domestic corn prices in 2016. A devalued currency incentivized producers to export remaining stocks of corn, coupled with an early start to the dry season, is severely limiting available domestic supplies. As a result Brazilian corn exports are up 138% from 2015 according to a recent GAINS report published by the USDA.

Inflated poultry feed prices

As a result, domestic prices increased up to 53.38 Reais (USD15.38) per 60kg bags, suggesting a port price of an estimated USD250 per ton. Stocks are estimated at a low 5.9 million metric tons (mmt), prompting buyers to seek foreign imports. Consequently, poultry and pork producers are struggling to maintain operations due to inflated feed prices.

This is a huge challenge for the sector to confront given that feed accounts for roughly 70% of production costs. Despite an initial increase in poultry production at the start of 2016, total Brazilian chicken output decreased by 10% over the past 3 months according to the Brazil Animal Protein Association.

Poultry exports more lucrative

Minimum poultry and pork production costs, which encompass primarily feed and energy expenses, increased on average by 50% in the first half of 2016. Meanwhile, producers continue to face persistent tighter profit margins.

Like corn, the poultry and pork sector benefited from a strong dollar on exports. Producers have turned their glance outwards to survive this time of tight margins. Poultry exports reportedly rose 15.48% in 2016, with major shipments to Russia and Saudi Arabia. Pork exports rose 69.8% in 2016, with major shipments to Russia and Hong Kong.

Intervention by Brazilian government

The Brazilian government sought to intervene in the corn industry to mitigate domestic costs. To relieve pressure on poultry and pork producers, the Brazilian government released nearly one million metric tons (mmt) of public stocks in May, but this did not provide substantial relief.

In April 2016, the federal government considered levying a 2.8% export tax on corn and soybeans as a means to bolster revenue and encourage domestic sales. The tax was seen as widely regressive and was met with much resistance from industry players. State-led policies, like the temporary waiver of the inter-state (ICMS) tax, also attempted to limit international exports but were unsuccessful.

Barriers to US corn market opportunities

The US corn market is currently priced as lowest in the world, suggesting strong exports. In January 2016, a single shipment of 20 MT of corn reached Brazil through the Port of Paranagua. However, the potential to export large volumes of US corn to Brazil is complicated by Brazilian biotech policy.

About 13-14 bio-tech events used in US corn production are not approved in Brazil, and there is a zero-tolerance policy for Low Level Presence (LLP) in corn imports. On the other hand, US poultry and pork producers are cautiously optimistic for a boost in exports to Brazil.

Alternative poultry feeds

Producers are seeking alternatives to corn feed with limited success. Brazilian producers have traditionally used low-quality feed wheat in instances of a bad wheat crop. However, strong export prices have also prompted wheat producers to increase exports of lower quality feed wheat. 3 producers from the South of Brazil have reportedly resorted to feeding chickens and pigs higher-quality grains normally used for human consumption in breads or cookies. If this pattern of human grade wheat consumption for animal use expands, flour prices will also rise. Wheat stocks therefore only provide a temporary solution to the struggling poultry and pork industry.

Brazilian consumers paying more for poultry

Producers have resorted to raising domestic prices for poultry and pork twice in 2016 to offset feed costs, subsequently threatening the demand for domestic consumption. Consumers will have to face increased costs due to the severe economic recession that is forecasted to continue for the next 2 years. As a result Brazilian consumers may turn to cheaper cuts of retail meat or increase consumption of staples like rice and beans.