US feed industry can recover with one good season

The United States’ feed situation can improve strongly and make good steps towards total recovery if only the country can get one year of good weather.

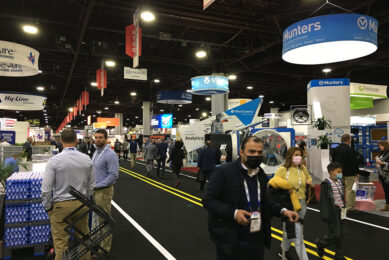

This was the key message of Dr Terry Barr, senior director of industry research at CoBank. He spoke at the International Production & Processing Expo (IPPE) in Atlanta, GA, United States where he delivered the Milton L. Dendy keynote address. His presentation was called ‘Drought, debt and politics drive economic and poultry outlook’.

Barr summed up reasons why feed prices have risen over the recent years, which includes factors on the demand side, like more demand for biofuels and ethanol, as well as an ‘insatiable appetite’ for feedstuffs from China. On the supply side, however, the US as a major feedstuff producer has been suffering from several consecutive years of bad weather. The 2012 persistent drought had a detrimental impact on crop growing in the Mid-West, which means stocks are low.

The situation in the US affected global feedstuffs supplies – and this could change rather quickly, he added. Barr pointed to the fact that global feed production surface has recently been increased by 18.2 million ha (45 million acres), and that it was simply weather that has limited the production. He said, “The continued low of global grain stocks could be solved – but it is going to take a lot of good harvests.”

He added however that forecasts for the coming months in 2013 do not look overly optimistic with continued drought projected in central US.

Forecasts

Barr also looked forward to the next five years in general, which can have profound influence on the feed and poultry industry. He mentioned phenomena as sovereign debt and solvency issues; subdued growth and fiscal monitoring; declining liquidity and rising interest rates; peaking biofuel growth; and grain stocks rebuilding.

Most importantly, he predicted a tempered growth in the emerging markets. With an average growth of only 2% predicted in the US and the EU, the emerging markets should not expect to reach double-digit growth figures, as they are dependent on their exports.