Modern breeds find their way to Uganda

Traditionally, poultry keeping in Uganda has been a backyard business with domestic strains being used. This is still the case to a certain extent, but thanks to economic growth, modern breeds and professional raising methods have found their way to the country too, offering reasonable benefits to growers.

By Richard Mugga, Kampala, Uganda

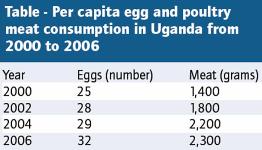

The Ugandan population of 30 million people is comprised of 75% Christians and 25% Muslims and non-religious denominations, such as animists. The country’s positive economic growth and development, which has been in the range of 5-8% over the past 10 years, has also been reflected in the continuing positive growth trends in production and consumption of poultry products in the country. From 2000-2006, egg consumption per capita increased considerably (28%) and poultry meat consumption rose by over 60% (Table).

Fast food outlets

Poultry meat is, of course, not the only meat consumed in Uganda. Rising levels in its consumption, however, can be partly attributed to the rapidly rising number of fast food outlets selling ready-to-eat poultry meat and eggs in a clean attractive environment. This is encouraging more people who had previously been eating poultry products only occasionally, to now consume them on a more regular basis. These fast food outlets serve the needs of the growing number of young middle-class people who often don’t have time to cook for themselves. In addition, the price of poultry dishes served from these fast food outlets is usually pocket-friendly, making them affordable for those even in lower income levels. These fast food chicken and other poultry products outlets are also popular with the ever increasing number of tourists visiting Uganda every year.

Modern breeds available

Although the meat and eggs from village birds continue to be well liked by many Ugandan consumers, who prefer the longer grown, hardier meat and eggs with a much deeper yellow yolk, the biggest supply of poultry meat and eggs to households, hotels, restaurants, and other catering units, and the retail and wholesale sectors of the market in Uganda continues to come from the modern bird breeds.

Most village birds in Uganda come from the many British introductions into the country, dating back to the 1920s and 1930s when Uganda was still a colony of Great Britain. Today, most of the village bird population in Uganda is made up of many cross breed varieties dating back from this period. But, although most of the poultry meat and eggs reaching the market are from the modern breeds, with no religious or other taboo associated with the production and consumption of poultry products, in most areas almost half of all households in Ugandan villages keep at least 20 birds each, mostly for the production of protein for own consumption.

Domestic production

In Uganda, Ugachic Poultry Breeders Ltd. continues to be a major player in the Ugandan poultry sector, owning one of the largest feed mills, a hatchery, bird rearing units, and a bird processing unit capable of processing up to 30,000 birds daily. However, most of the hatcheries in the country often import parent stock as fertile eggs, which are then hatched domestically. A number of the bigger hatcheries and breeding companies also have contract broiler rearing schemes in place through which they provide day-old chicks to contract farmers who then grow them. These birds are then sold back to the breeders/hatcheries when they have reached the required market weight, leaving a reasonable profit for the growers.

Various slaughter weights

In Uganda, the age at which broiler birds are slaughtered is often determined by demand. Birds slaughtered at the age of slightly over a month often weigh about 800 g live weight, while those slaughtered at the age of about a month and a half often weigh 2.5 kg or more live weight, depending on the breed used. On the better managed broiler growing units in Uganda today, the feed conversion ratio lies between two and two and a half. In most areas of Uganda, the price of a day-old broiler chick is 1,000 Ugandan shillings (US$0.50), while that of a layer chick is 1,800-2,000 shillings (>$1). The farm price of a medium-sized broiler is about 6,000 shillings ($3), often leaving the contract grower with an average margin of 1,000-1,200 shillings per bird (<$0.60). Looking at the retail prices of broilers, the very small birds are retailed at 4,500-6,000 shillings ($2.30-3), medium-sized birds are retailed at 8,000-12,000 shillings per bird ($4-6), and the very heavy birds are often retailed at 20-25,000 shillings per live bird ($10-12).

Low egg prices

Looking at commercial egg production in Uganda, Shaver and Hy-line birds continue to be the most popular, with both day-old chicks and fertile eggs imported and hatched domestically. The majority of Ugandan producers prefer to keep their birds in production for up to one and a half years. To them, this is usually more profitable and cost-effective than culling after one year. On most layer units in Uganda, the mean annual production per bird stands at 230-240 eggs, and the farm gate price stands at 100-150 shillings per egg ($0.05-0,07). According to size, this usually leaves the farmer with a profit margin of about 10-12% per egg. Producers, however, continue to complain that trade and retailers take the lions share in terms of the profits made from egg sales. For example, for those farmers who grade their eggs weighing 50 g are usually sold to retailers at 3,000 shillings ($1.50) per tray of 30 eggs. The retailers then sell the eggs at 4,500 shillings ($2.30) per tray, making a profit of 50%. Eggs weighing 55 g are sold by the farmer to the retailer at 4,000 shillings per tray of 30 eggs, and the retailer then resells the eggs to the consumer at 6,000 ($3) shillings per tray, making a profit of 50%. Culled layer birds are often sold by Ugandan farmers at the gate at 4,500- 6,000 ($2.30-3) shillings per bird depending on the size and weight of the bird.

Culled layers, having been grown for a much longer period, produce hardier meat, which continues to make them very popular with many Ugandan consumers, with a higher price often being paid for the brown fleshed layers.

Local feed ingredients

Uganda is almost 100% self-sufficient in the production of all its poultry feed requirements, although some imports of mainly vitamins and a few other additives continue. In order to cut costs by Ugandan poultry producers, feeds are comprised of mostly by-products of maize and wheat flour milling as major sources of energy. Also, the supply of protein for the Ugandan poultry industry continues to come mostly from domestic sources. With regard to poultry feed packaging and labelling, legislation requires that all the commercial feed mills clearly show on each feed bag all the components and percentages of the ingredients, date of manufacture, as well as sell-by date. This legislation, however, is in many cases not fully enforced by the relevant authorities.

No 2 Volume 25 2009