Romania’s poultry industry remains strong amid challenges

In spite of Covid-19-related challenges and foreign competition, the poultry sector remains a leader among Romania’s food and agriculture industries.

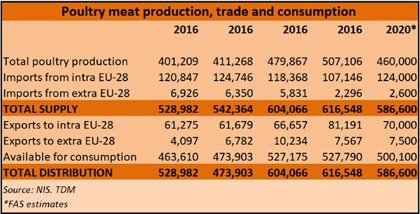

The poultry sector is one of Romania’s most dynamic agricultural industries in terms of growth, performance indicators, and export markets. However, the Covid-19 pandemic and foreign competition have negatively affected the sector’s outlook with domestic poultry meat production forecast to drop by 9%. Regardless, the poultry sector remains a leader among Romania’s food and agriculture industries and poultry companies continue to invest in production and processing technologies.

Competitive production costs, reasonable feed prices, evolving consumer demand, and challenges to the hog sector (most notably African Swine Fever) have all driven Romanian poultry production growth. In 2019, the country slaughtered almost 300 million birds, producing 672,312 mt liveweight of poultry meat, 95% of which was chicken meat (70% broiler and 25% hens), according to a USDA GAINS report. In the same year, Romania was the EU’s 8th-largest poultry producer.

Poultry meat accounts for 45% of total Romanian animal protein production and was Romania’s most widely produced meat last year, followed by pork, beef, and mutton. Just 10 years ago, pork accounted for the lion’s share of 41% of animal protein production, followed by poultry meat (34%) and beef (18%).

The efficiency of chicken production has improved over the past decade according to the Romanian Poultry Producers Association. The average daily weight gain rose from 53g in 2011 to 55-56g in 2019, while average feed consumption declined from 1.88kg feed/kg of meat in 2011 to 1.62kg feed/kg of meat in 2019.

At the beginning of 2020, the highly pathogenic avian influenza outbreak on a commercial layer farm prompted 18,700 laying hens to be culled but did not spread to other farms. Furthermore, the Covid-19 pandemic has negatively affected Romania’s poultry sector, as has increased competition from imports.

Widespread closures among restaurants and catering businesses, as well as other Covid-19 mitigation restrictions, will likely result in a 5% year-on-year reduction in poultry consumption in 2020. The poultry industry remains hopeful that demand for Romanian poultry may rebound during the second half of 2021.

Poultry consume majority of compound feed

The National Feed Manufacturing Association in Romania noted that in 2019, the poultry sector consumed 56% of the total compound feed manufactured in the country. Although 2020 was an exceptional year because of severe drought conditions, Romania’s poultry sector generally benefits from access to competitively priced domestic feed grains. However, in 2020, feed commodity prices soared, resulting in 20-25% increase in the price of compound feed and significantly higher input costs. Despite higher production costs, producers were not able to recoup losses by raising consumer prices because of the dramatic changes to the market after the Covid-19 outbreak. October 2020 EU Commission data notes Romanian poultry meat was 12.5% cheaper than in 2019. From May through October 2020, average domestic poultry prices reached just 68-74% of the overall EU average price.

Avian influenza (AI)

Avian influenza (AI)

Find out more about the causes and effects of avian influenza and many other poultry diseases in the Poultry World health tool.

The impact of Covid-19

During the early stages of the Covid-19 pandemic, chicken meat sales surged as consumers stockpiled for a potential lockdown. Retail sales increased but they could not offset the loss of sales in the food-service sector. An oversupply of chicken resulted. To date, most large Romanian poultry farms have been spared major personnel Covid-19 outbreaks, although expenses related to supplementary cleaning, personal protective equipment for employees, and employee transportation have increased production costs.

Specific to the poultry sector and the Covid-19 pandemic, the Romanian government approved a subsidy programme in September 2020 with a total estimated budget of US$ 26.8 million.

Covid-19 Update

Covid-19 Update

What impact is the pandemic having on the global poultry sector and how are they dealing with it?

An increase in poultry imports

In 2020, chicken meat imports during the first 7 months of the year reached 76,000 mt, a 16.5% increase over the same period in 2019. All but 2% of these imports (Ukraine and Brazil) originated from other EU member states. Romania’s top supplier is Poland, which doubled its exports to Romania during the first 7 months of 2020 to 25,611 mt, overtaking Hungary (14,107 mt). Other suppliers include Germany (9,514 mt), the Netherlands (6,714 mt), the UK (6,081 mt), and Bulgaria (2,865 mt). By volume, frozen meat accounted for 65% of imports while chilled/fresh meat accounted for approximately 25%.

Exports increased from 68,461 mt in 2016 to 88,758 mt in 2019, but remained mostly flat during the first 7 months of 2020, at around 50,000 mt. Boneless cuts account for a major share of exports and are almost equally distributed between fresh/chilled and frozen (around 42% each), with the balance consisting of meat preparations. In the first 7 months of 2020, major export markets for Romanian chicken meat were Bulgaria (10,619 mt), Hungary (10,091 mt), the UK (5,483 mt), and France (5,210 mt).