Poultry, meat and eggs, 2012–2022: Was it the decade of Asia?

Avian influenza, African Swine Fever, Covid-19 were 3 viruses that dominated the global agricultural headlines over the past decade. One may assume they caused a setback in global development of production volumes of meat and eggs. But no, on the contrary, production levels grew everywhere with some remarkable differences per continent and country.

To answer the question in the title, between 2012 and 2022, Asia was able to maintain its dominant position in most markets — poultry, eggs and pork, despite suffering losses in pork production.

But does that confirm projections by the US Department of Agriculture (USDA) towards the end of the first decade? Soon it would be Asia’s decade, they said. And the OECD-FAO did the same. It was not all smooth sailing, to say the least, as from 2011 onwards, forecasts had to be revised significantly. Unwanted pathogens emerged, like avian influenza, African Swine Fever (ASF), and Covid-19. Not only did those slow down the economic development, but in some cases even led to a decrease in the gross national product.

So what tendencies can be found underneath that picture of the dominant position? This article documents the dynamics of global production of meat and eggs, the most important protein suppliers alongside milk between 2012 and 2022, at continent level, as well as for the leading producing countries and to identify the main steering factors.

Differences at continent level

There were considerable differences in both the absolute and relative increase in production for the 3 meat types and eggs analysed here (see Table 1).

Chicken and eggs at continent level

It is worth noting that the 2 poultry products showed by far the highest absolute and relative increases. This reflects what could be called “the red-white shift among consumers from red to white meat” on one hand, and the increased appreciation of eggs as a source of protein on the other, as well as the lack of religious barriers to the consumption of these products.

In contrast, pork and beef are banned from consumption in a number of religious communities. Added to this are the higher production costs due to the less favourable feed conversion rate.

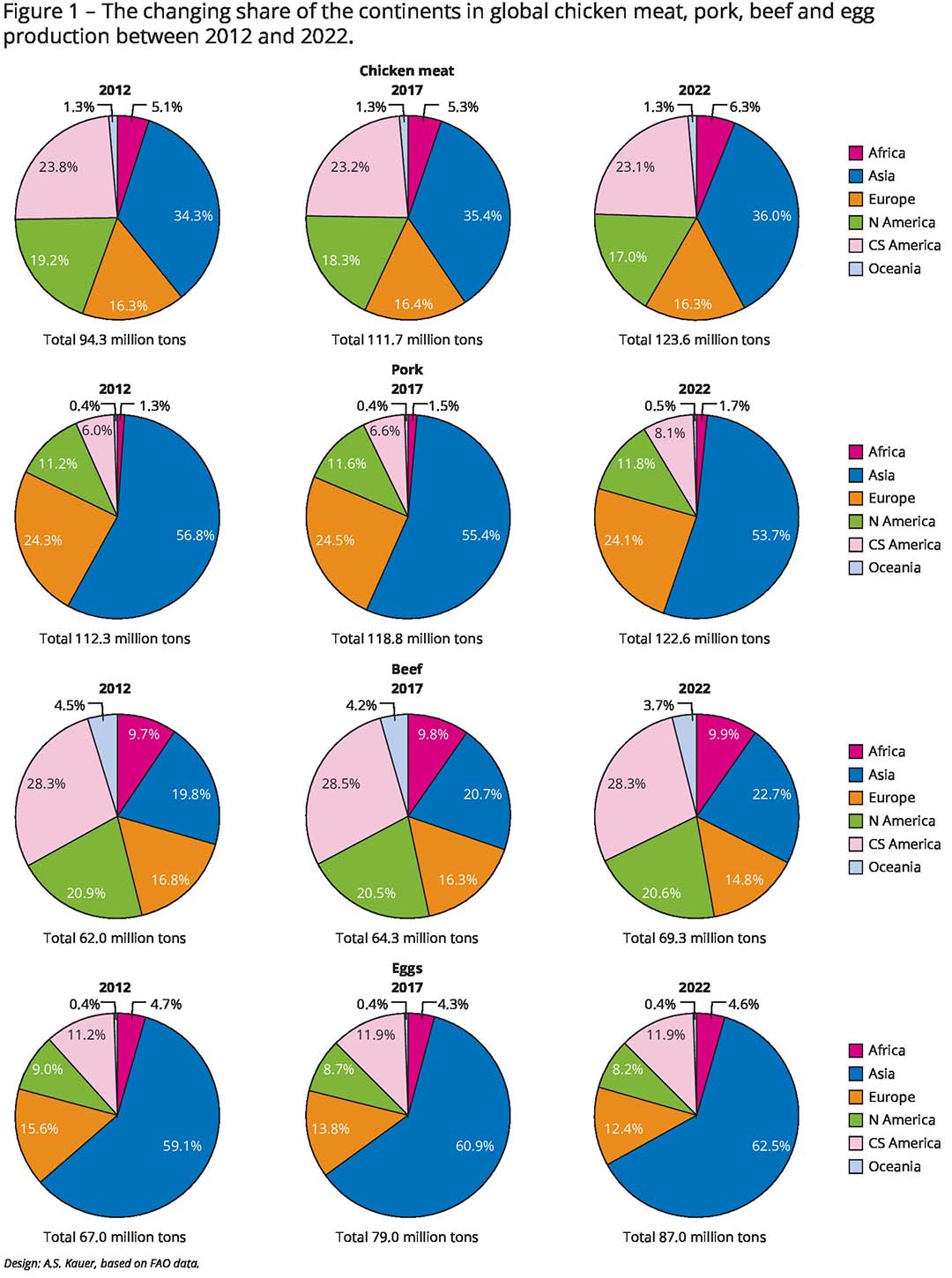

A closer look at the 4 products regarding the development of their shares in global production at continental level between 2012 and 2022 provides interesting insights (Figure 1, Table 2). North America and also Central and South America lost shares in chicken meat, Europe and Oceania were able to maintain their positions, Africa and Asia gained shares. Asia’s production volume increased by 12.1 million tonnes or 37.4%, Central and South America followed with 6.2 million tonnes or 27.5%. Africa recorded the highest relative growth rate at 65.2%, however, the low initial value of only 4.7 million tonnes in 2012 must be taken into account.

Asia contributed 41.4% to the global increase in chicken meat production in the decade under review, followed by Central and South America (21%) and Europe (16%). It is worth noting that the African countries recorded a higher absolute growth than North America. It has to be considered, however, that the US has dominated global production for decades, domestic consumption is only increasing slowly and the international market is highly competitive.

Pork at continent level

Although Asia remained the undisputed leader in pork production, the continent only ranked third behind Central and South America and Europe regarding the absolute and relative growth in production volume. The comparatively lower increase is a result of the outbreaks of ASF in China and other countries in East and South Asia.

Beef at continent level

At first sight, it is surprising that Asia recorded the highest absolute increase in beef production of all continents, at 3.4 million tonnes. Central and South America as well as North America fell far behind. The continent contributed 46.9% to the global increase in production, 29% more than North America and 19% more than the countries of Central and South America. Growth in Europe and Oceania continued to decline. The rapid increase in Asia is primarily due to developments in China, as will be shown later.

The gap between Asia and the other continents was even more pronounced in terms of the increase in egg production. Of the almost 20 million tonnes more produced in 2022 than in 2012, Asia accounted for 14.8 million tonnes or 74.1%. Only Central and South America recorded a notable growth, although it was only around a fifth of the increase in Asia. At just 3 million tonnes, the absolute growth in Europe was even far lower than in Africa. An already high per capita consumption and, in some cases, significant production losses due to outbreaks of avian influenza explain the low momentum; the same applies to North America.

As an interim result, it can be stated that Asia recorded the highest absolute increases in the production volume for chicken meat, beef and eggs in the period analysed here and consequently also the highest relative shares in the global growth.

Only in pork production it ranked third behind Central and South America and Europe. This reflects the massive animal losses caused by the outbreaks of ASF.

Large differences at country level

In a second step, the development of meat and egg production for each of the 15 leading countries between 2012 and 2022 will be documented. The 4 products will be analysed in order of their absolute increase in production volume.

Chicken at country level

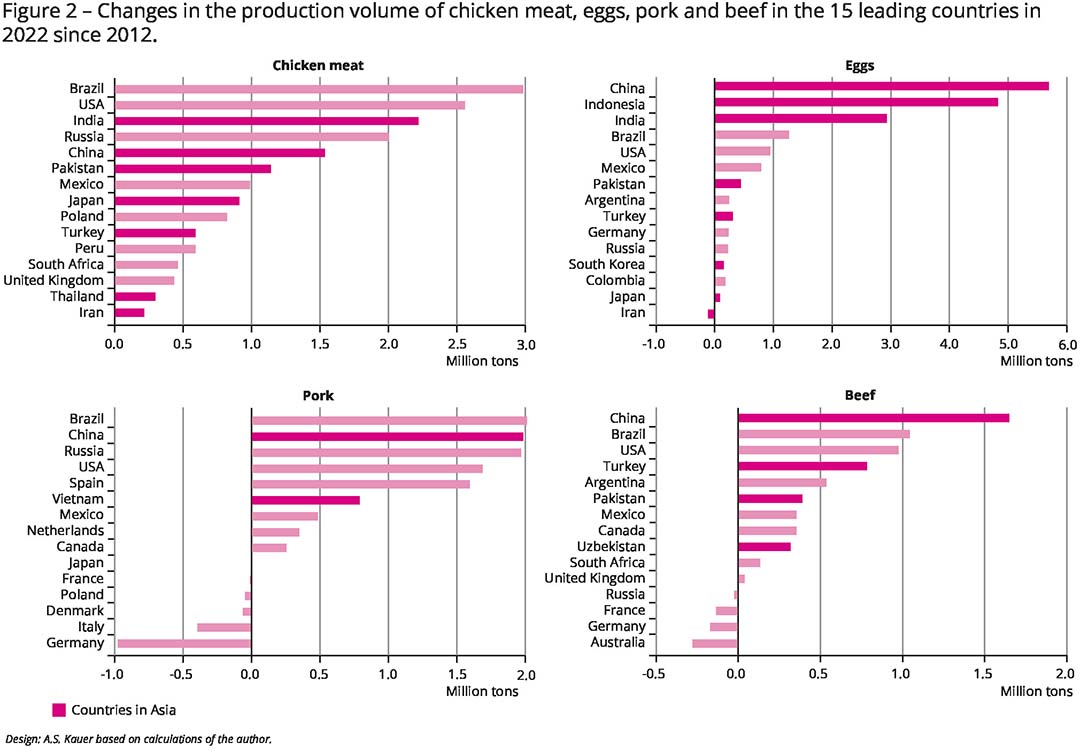

Between 2012 and 2022, the global production of chicken meat increased by 29.3 million tonnes or 31.1%. The top 15 countries accounted for 17.8 million tonnes or 60.7% of this growth. Figure 2 shows that production volumes increased in all 15 countries. Brazil, the US, India and Russia recorded the largest absolute growth. Together, they accounted for 55% of the increase in production. The high growth of 1.1 million tonnes in Pakistan is remarkable. At 137.1%, the country had by far the highest relative growth rate, followed by India (83%), Japan (62.7%) and Russia (60.9%). Although production in China also rose by 1.5 million tonnes, the country recorded the lowest figure in the country group at just 12.1%.

Of the 15 leading countries, 7 were in Asia, 4 in America, 3 in Europe and 1 in Africa. The 7 Asian countries accounted for 23.6% of the global increase, while the 4 countries of the 2 American continents accounted for 24.3%. A comparison of the developments on the 2 continents shows that Asia, with a share of 41.4%, ranked well ahead of the Americas with 30.8% (Table 2).

Eggs at country level

Global egg production grew by 20 million tonnes in the analysed decade. Of this, the 15 leading countries accounted for 18.1 million tonnes or 90.6%. Figure 2 shows that production volumes increased in all countries except Iran. Of the leading countries, 8 were in Asia, 5 in America and 2 in Europe. With China, Indonesia and India, 3 Asian countries ranked in the top positions. Together, they shared 13.4 million tonnes or 74.2% in the increase of the country group and 67.2% in the global increase.

China was the undisputed leader (5.7 million tonnes), followed by Indonesia (4.8 million tonnes) and India (2.9 million tonnes). The increase in production in Brazil (1.3 million tonnes), the US (0.9 million tonnes) and Mexico (0.8 million tonnes) was significantly lower. The development in Indonesia is remarkable, with a relative growth rate of 421.2%, more than 5 times higher than India (79.8%). A comparison of the shares of the 2 continents in the increase in global egg production shows that Asia, with 74.1%, ranked far ahead of the 2 Americas with 19.9%.

Pork at country level

Global pork production increased by 10.3 million tonnes or 9.2% in the period under review, and by 9.7 million tonnes or 10.3% in the 15 leading countries. Figure 2 shows that production volumes decreased in 6 of the 15 countries. With the exception of Japan, all countries were in Europe. The decline was particularly sharp in Germany at almost 1 million tonnes and in Italy at 0.4 million tonnes.

With total production of 55.4 million tonnes in 2022, China continued to play an undisputed leading role, but was slightly behind Brazil (+2.04 million tonnes) in terms of the increase in production volume (+1.98 million tonnes). Russia, the US and Spain ranked next, as can be seen in Figure 2. Russia achieved the highest relative growth rate with 77.1%, followed by Brazil (64.6%) and Spain (46.4%). The highest relative decreases were in Italy with 24% and Germany with 17.9%.

In contrast to the 2 poultry products, Asian countries accounted for a much smaller share in the growth in global pork production in the decade under review, at just 20.5%. The American double continent was the undisputed leader at 49.7%, followed by Europe at only 22.6%. The outbreaks of ASF in China and other countries in East and Southern Asia explain the low growth rate in production in Asia. Different dynamics were recorded in Europe. While production rose in Russia, Spain and the Netherlands, it fell in Germany and Italy. Changes in per capita consumption and foreign trade were the key drivers.

Beef at country level

Of the products analysed here, beef recorded the smallest increase at 13.3 million tonnes. The 15 leading countries contributed 6 million tonnes or 45%. Production volumes fell in 4 of the leading countries between 2012 and 2022, 3 of which were Europe. Australia recorded the highest absolute decline at 274,000 tonnes, followed by Germany (-169,000 tonnes) and France (-133,000 tonnes).

At first glance, it is surprising that China had the largest absolute increase at 1.6 million tonnes. Brazil, the US, Turkey and Argentina followed in this order, all countries with extensive natural grasslands. The high growth in China must be seen in the context of the massive decline in pork production. In order to secure the meat supply for the population, domestic production was expanded and, in addition to pork, chicken meat and beef were imported. A further steering factor was the increase in the per capita consumption of beef in affluent consumer groups in urban centres. The consumption of this comparatively expensive meat type is seen as a status symbol.

Of the 15 leading producing countries in 2022, 4 were in Asia and contributed 2.1 million tonnes or 52.5% to the increase in beef production of the country group and 23.6% to the global increase since 2012. If one compares Asia and the American double continent in terms of their share in the global production growth, Asia ranked only slightly ahead of America with 46.9% and 46.4%, respectively.

The continuing decline in beef production in some European countries reflects the aftermath of the BSE crisis. BSE first appeared in England in the mid 1980s and then in other European countries, leading to a massive slump in beef consumption that was not compensated for in subsequent years. The higher production costs compared to poultry meat also played a role. This was reflected in the retail price and resulted in a reluctance of the consumers to buy.

Summary and perspectives

Asia recorded by far the highest absolute and relative growth rates in the production of chicken meat, eggs and beef. In contrast, only a small increase was achieved in pork because massive animal losses occurred due to outbreaks of ASF. However, more recent data from China show that production rose again quickly and was even higher in 2023 than in 2018.

The decade between 2012 and 2022 was largely characterised by Asia in terms of meat and egg production, even if there was a dip in pork production due to the epidemics. In view of the continued rapid population growth and the increasing purchasing power in a number of countries, it can be assumed that Asia will be able to consolidate its leading role.